Bella Collina Community Unsafe For Jogging And Walking

Bella Collina POA/HOA association, poor management, broken pavements, unsafe for jogging and walking, dangerous community. Dwight Schar, controls the POA/HOA with rubber stamp board members like Dr. Jeremy Spry and Paul LeBreux.

Rick Scharich and Paul Labreux are accused of fraud, scam or preditory real estate lending

In a counter lawsuit filed against PSR Developers, which is owned by Rick Scharich and Paul LeBreux, it’s alleged that the two were involved in a possible real estate scam.

Bella Collina Sign Discrimination & Controversy

Bella Collina HOA and POA are solely and fully controlled by Dwight Schar who was banned for life from the NFL

More Trashy Piles In Bella Collina

This pile of garbage located at the entry is left for weeks because HOA does not care.

Unsafe in Bella Collina – risky broken pavements

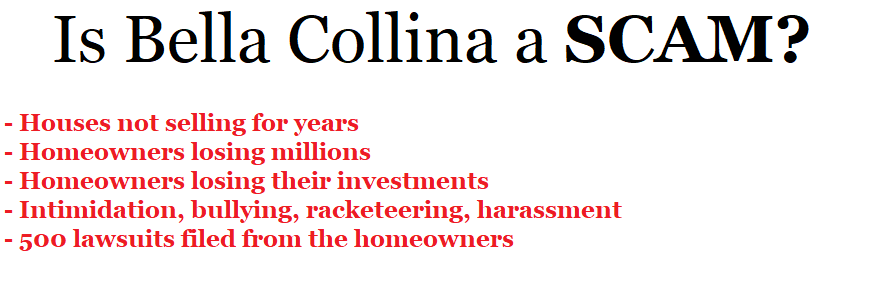

Based on court filings against Bella Collina & Dwight Schar, hundreds of residents are unhappy, gave up their property, and lost about $500 million. There are hundreds of court cases AGAINST BELLA COLLINA and its HOA & POA.

Five years for sale: 16623 Arezo Ct, Bella Collina, FL 34756 – Dropped $1 million – Owner Lost maybe Another $1 million

Richard Arrighi (acting manager), Randall Greene (maintenance guy) and Paul Simonson (Dwight Schar finance guy) who work for Dwight Schar are not doing so well in Bella Collina based on this gloomy house and almost no home or condo sales for the last one or two years.

822 day for sale and no one wants a deal in Bella Collina

The desperate homeowner has already lowered his price by $1 million (!) which means that the house was originally priced 50% higher and look at the drop!

Bella Collina Real Estate Property: 80% price drop and still no buyer after long 611 days (almost 2 years) 😱

FACTS: in 2018 homes only 6 homes sold (Zillow) and for an average of $186 sf after 44 months wait. Consider that lots and homeowners pay $8,000 dues and an additional property tax + 5% value of money + 6% cost to sell the property.

Bella Collina real estate in trouble, again? falls to $195 sf

Don Juravin REVEALS unstable prices in Bella Collina. Bad investment for 500 families who lost $500 million. Dwight Schar, the owner of Bella Collina Florida, is involved in additional businesses like NVR, Inc. (NYSE: NVR) which sells under: Ryan Homes, NVHomes and Heartland Homes brands. It seems like all are under congressional investigation.

Bella Collina Lots Seem to Lose $5 million in Bad Real Estate Investment

My very rough math shows that is Bella Collina property bought in 2012 for $3.75 and sold it (or it has a value change) in 2019 for $75,000 or $200,000 he/she have lost about $5 million. WOW.

Bella Collina houses become cheap rentals at a possible loss to homeowners

Going for a cheap losing 4% annual rather than 8-10% a year.Not the only rentals in this remote location (45 minutes from downtown Orlando and not 20 min as advertised). Why do residents not maintain their residence in Bella Collina?!

Bella Collina House not selling in already six years – Losing est. $2.5 million

Six years since owners first try to sell the Bella Collina house at $3.45 million, interchanging 7 or 8 realtors, losing already $1.1 from asking price, about $1 million in value of money (interest rate) and probably about $400,000 in tax, fees, Club, HOA, maintenance, etc

Bella Collina Homeowners Continue To Lose Their Investments

Don Juravin: Dwight Schar continues to be responsible for homeowners losing money in Bella Collina when his manager is Paul Simonson and his “enforcer” is Randall Greene.$1 million loss or est 130% of investment lost! $740K > 6 yrs later down to $40K.

Bella Collina home not selling already for more than 800 days

We found home prices in Bella Collina falling as low as $192 sf over the last 10 years. Bella Collina is a ghost town already 18 years with only about 7 to 9 percent real family year round occupancy. There were little sales despite the desperate affords of Randall Greene. Paul Simonson and the owner, Dwight Schar.

15317 Pendio Dr, Bella Collina, FL 34756 ($3,389,000 6,502 sqft) – Bella Collina Home Buying Guide

Other properties on Bella Collina were sold at about $200 per sf and since there are some 700-800 deserted lots available and almost no demand (Don Juravin found 1 sales this year on the Lake County appraisal) I think this house is presented at twice the value.

63 Months No Sale Despite a Drop of 32% In Price – 16623 Arezo Ct, Bella Collina, FL 34756

How much Bella Collina homes drop in price? How long does it take to sell a house in Bella Collina? Can Zillow be manipulated by Bella Collina real estate or homeowners?

40 months no sale Bella Collina Home – 15333 Pendio Dr, Bella Collina, FL 34756

Bella Collina approved the Richard Arrighi and his Phoenix Companies to build in Bella Collina and no Bella Collina Real Estate to trying to sell the house.

$900,000 real estate loss in Bella Collina

The lot bought for $850,900 and sold for $100 after 3 years. Considering the cost of sale, Club dues, HOA, attorney fees and cost of money, I would assume the Bella Collina investor lost $900,000. A couple of years ago, it was sold for $27,500 only.

Lake Apopka: The New Florida Swampland Scam

There are two ultra luxury communities that are being built on the shores of the so called pristine Lake Apopka, namely Bella Collina and Oakland Park, which I have no idea who is buying these lakefront properties.

It will help housing sales- 3.6% lowest unemployment since 1969

A record 103 straight months of job gains and signaling the current economic expansion shows little sign of stalling. The unemployment rate fell to its lowest level in half a century last month, capping the longest streak of job creation in modern times and dispelling recession fears that haunted Wall Street at the start of the year.

Homeowner lost $1,277,000 (est) in Bella Collina real estate

Huge investment loss in Bella Collina real estate: 14 years of paying Club, tax, HOA = $154,000 + $518,000 money value + $565,000 actually loss + potential $40,000 club = estimated $1,277,000 investment loss in Bella Collina lot.

Shady Rusty Moore is affiliated with Bella Collina to sell Home Security – be careful

“Extremely disappointed and irritated with this company. Have had this for just about 2 months. 1st doorbell installed from the Safe Streets did not work and kept freezing. Called the tech **** and had him out I the Ring doorbell. Still had trouble with it.